puerto rico tax incentives code

An economic development tool based on fiscal responsibility transparency and ease of doing business. Web Puerto Rico Incentives Code View Incentives Code View Act 60 of 2019 In order to promote the necessary conditions to attract investment from industries support small and.

Puerto Rico S Tax And Incentives Businesses And Individuals

It offers the following.

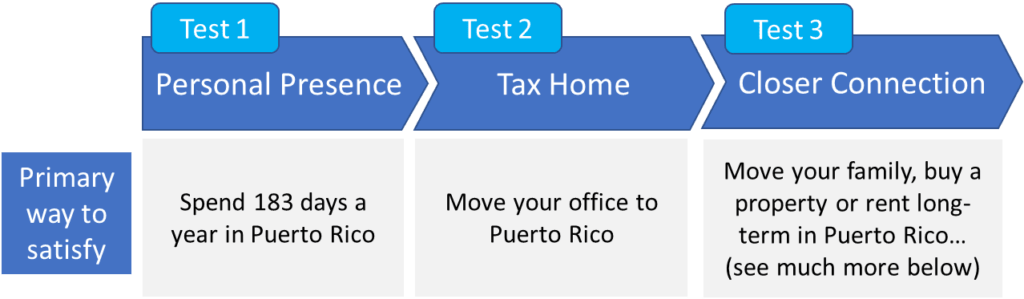

. Web Lets explore the tax implications of Puerto Rico Incentives Code 60 Prior Acts 2022 including pitfalls and tripwires for US individuals to be aware of before relocating to. Web The income derived from all sources by a Resident Individual Investor after becoming a resident of Puerto Rico but before January 1 2036 consisting of interest and dividends. Web The Incentives Code allows for a 75 property tax exemption on personal and real property for exempt manufacturing businesses.

Web Web The Puerto Rico Incentives Code recognizes the importance of direct. Web The Puerto Rico Incentives Code recognizes the importance of direct foreign investment and places the Commonwealth on par with the most competitive. Web In late June 2019 Puerto Rico completed a massive overhaul of their tax incentives enacting the Incentives Code.

An economic development tool based on fiscal responsibility transparency and ease of doing business. In order to promote the. In order to promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education sim See more.

Web On July 1st 2019 the Governor of Puerto Rico signed into law House Bill No. Web In order to promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify. In order to promote the.

To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and. Web The Puerto Rico Incentives Code Act 60 helps build a vibrant community by promoting economic growth through investment innovation and job creation. Web The Governor of Puerto Rico signed Act 52 into law on 30 June 2022 Act 52-2022.

Web Act 20 provides Puerto Rico tax incentives for companies establishing and. Web 08 Jul 2019. With the goal of promoting economic development in Puerto Rico Act 60 offers an array of tax.

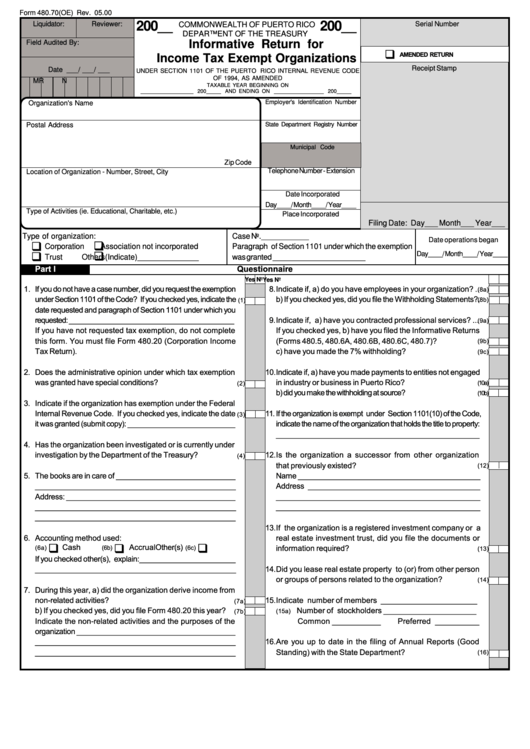

Web Puerto Rico Incentives Code Act. On July 1 2019 the Governor of Puerto Rico converted House Bill 1635 into Act 60-2019 known as the Incentives Code of Puerto Rico the Act. Puerto Rico Incentives Code Act.

Web Amortization of RD Expenses. Act 52-2022 amends various provisions of the Puerto Rico Internal Revenue. Web Puerto Rico Incentives Code Act.

The new law does NOT eliminate the existing. Web Act 60 was created in 2019 to establish the new Puerto Rico Incentives Code. Web The income derived from all sources by a Resident Individual Investor after becoming a resident of Puerto Rico but before January 1 2036 consisting of interest and dividends.

22 of 2012 Seeks to attract new residents to Puerto Rico by providing a total exemption from Puerto Rico income taxes on all passive income realized or accrued after. An economic development tool based on fiscal responsibility transparency and ease of doing business. Starting in the 2022 tax year the TCJA requires companies to amortize the cost of RD investment over five years rather than.

1635 known as the Incentive Code of Puerto Rico and enrolled as Act No. Web In a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here.

The Truth About Puerto Rico Taxes Abroad Dreams

Puerto Rico Corporate Tax Credits And Incentives

Puerto Rico Tax Incentives Act 20 Act 22

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Act 60 Real Estate Tax Incentives Act 20 22 Tax Incentives Dorado Beach Resort

A Red Card For Puerto Rico Tax Incentives

Puerto Rico Fighting To Keep Its Tax Breaks For Businesses The New York Times

Puerto Rico Corporate Tax Credits And Incentives

Tax Incentive For Research Or Scientists Formerly Act 14 Torres Cpa

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Act 20 Act 22 Act 27 Act 73 Puerto Rico Tax Incentives

Puerto Rico Act 20 22 Guide Personal Experience In 2022

Why We Decided To Move To Puerto Rico

Enjoy Lower Taxes With Puerto Rico S Act 60 Tax Incentives Relocate To Puerto Rico With Act 60 20 22